TIF Districts

A Tax Increment Financing Development District (TIF) involves the creation of a geographically defined district in the City and the "capture" or reinvestment of some of the new increased or "incremental" tax revenues generated by new development and business expansion in the District to pay certain costs of development and certain costs of new public facilities, improvements, and programs.

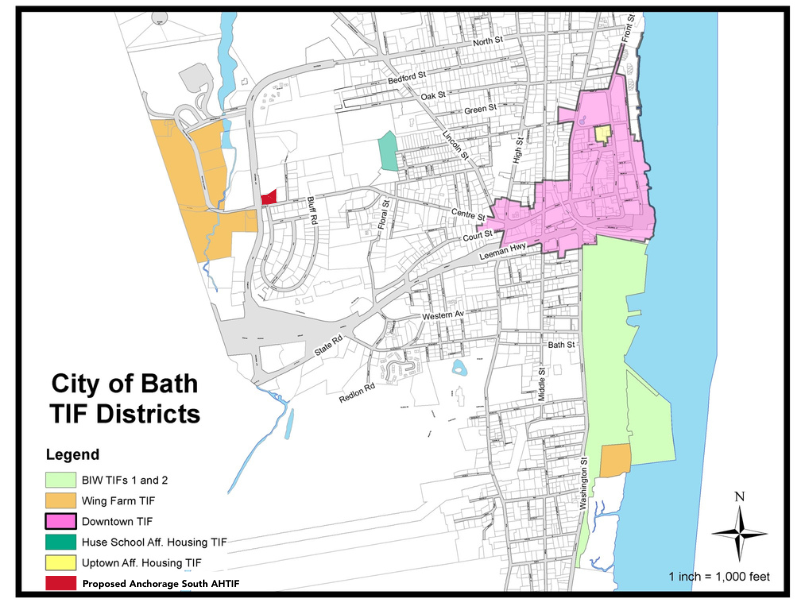

The City of Bath has five current TIF Districts and one proposed:

- Bath Iron Works TIF District

- Downtown TIF District

- Wing Farm TIF District

- Huse School AHTIF District

- Uptown AHTIF District

- PROPOSED Anchorage South ATIF District

A full presentation explaining TIF types, uses, and policy can be viewed here

Key Features and Benefits of Municipal TIF and TIF Districts:

- Maintain existing tax revenues

- Enhance future tax revenues generated by new development throughout the Town

- Create long-term, stable employment opportunities for area residents

- Attract Businesses and promote the economic viability and sustainability of the general economy of the Town

- Improve the District and Town infrastructure to attract and retain commercial development and business operations.

For more information, contact Misty Parker, Director of Economic & Community Development at mparker@cityofbath.com or 207-443-8330

Director of Economic and Community Development

Misty Parker

Work: 207-443-8330

General Information

Phone Numbers

207-443-8330